Strategies for the piggy bank

Freiburg, Sep 05, 2018

Where to look other than stealing? It certainly is not an option for start-ups. But most young entrepreneurs have to ask themselves: Where can we get financing? Three Freiburg start-ups explain how they received financing and report on the advantages and disadvantages of various models: Tomes GmbH applied for money for its anamnesis software Idana through crowdfunding; cytena GmbH, a manufacturer of single cell printers, has a business angel as its partner; and CorTec GmbH builds microelectrodes and neuro-implants with financial contributions from asset managers of wealth families or so-called family offices.

Crowdfunding, business angels and asset managers of wealthy families are three models through which Freiburg start-ups had found financing. Photo: Fotofabrik/Fotolia

Tomes: Total control through crowdinvesting

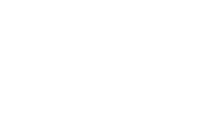

Tomes GmbH most recently financed Idana, its anamnesis software for doctors, through crowdunding or crowdinvesting. “Idana records and documents the patient’s medical history, for example, before his or her first appointment,” explains business manager Lucas Spohn. Patients simply fill in electronic questionnaires that match their concerns. In addition, the questions adapt to the previous answers. Lastly, the software clearly presents the data results and does routine work for physicians. “You have more time to talk to the patients,” says Spohn. It could lead to more accurate diagnoses.

The concept appealed to scouts from the crowdfunding platform Companisto. They approached Spohn and his colleagues: “The administration is very lean there, and large sums of money can be raised.” 500,000 euros were collected in four months by 700 small investors. They have no voting rights so the founders retain full control over their start-up. At the same time, the swarm of investors forms a broad network of supporters and reinforces word-of-mouth propaganda.

“But we do not have a singular strong partner for that, someone who could offer us economic expertise and commitment,” says Spohn. In addition, high costs have been incurred during financing because Companisto charges high commissions for its services and mediation. In the crowdfunding campaign, the Tomes team worked for a month - on a video, new lyrics and graphics. “I would still do it again and recommend it to other startups,” he emphasizes. Tomes, Spohn’s first company, has previously been funded with an EXIST Grant from the Federal Ministry of Economics and Energy and a business angel. Currently, hospitals are particularly interested in Idana. The software covers four disciplines: general medicine, psychiatry, cardiology and radiology. Idana is set to kick off in 2018 with a major update of the software and its contents.

The anamnesis software Idana takes care of doctors’ routine work, leaving more time to talk with patients. Photo: Tomes GmbH

cytena: Business angels are passionate about their projects

Specifically, cytena GmbH was looking for a business angel - for individuals willing to invest. “We applied to pitching events,” says Benjamin Steimle, CFO. In the foreground there are commercialization and cost plans with exact numbers for items such as rent, staff and equipment, which needs to be included in the presentations. Cytena found a “lead” investor who invested 600,000 euros and an institutional investor who contributed 500,000 euros. Steimle recommends business angels - provided the chemistry is right, something that is not always clear right off the bat. “The collaboration is very good for us,” he says happily. Business angels bring many valuable contacts and know-how along with them. They invest in areas of expertise that they know as well as their own money. That’s why they are passionate about it. “You marry the company with this person,” says Steimle. Last but not least, business angels have no rigid requirement catalogs such as venture capitalists.

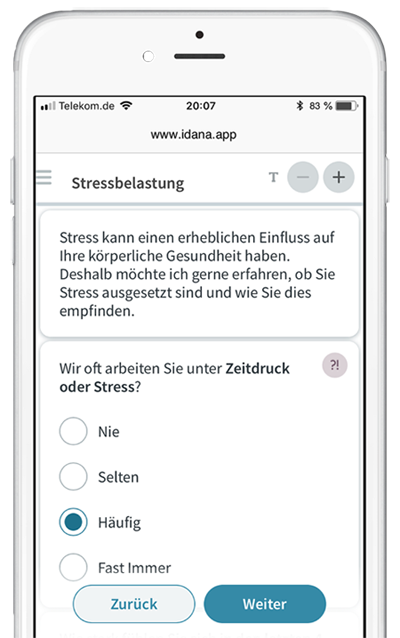

Cytena manufactures single cell printers. The devices provide five photos for each individual cell. “Users can determine if they really only want to work on one cell at a time,” explains Steimle. The new x.sight series sorts and separates all kinds of cells, which remain quite viable. They are suitable for developing pure cell lines. They are often used to make proteins that later come on the market in the form of medicine. But even for customized cancer therapies, it is necessary to genetically characterize individual cells.

Steimle and his colleagues did not want to get a large corporation on board as their strategic partner - they would have had to give up too much freedom in the management of their start-ups. “We also played through various scenarios with crowdfunding,” says Steimle. The cytena concept appeared too specific to be able to convince many laymen quickly of the idea of the company. The start-up has already been able to acquire a seven-figure amount through publicly funded projects and the EXIST research transfer program of the Federal Ministry for Economic Affairs and Energy.

The patented technology recognizes, photographs and prints individual cells. Photo: Cytena GmbH

CorTec: Family offices for long-term success

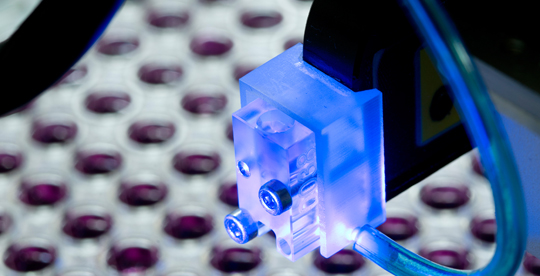

CorTec GmbH develops microelectrodes and active neuro-implants that can stimulate nerve cells and derive cell signals. “Our technology works more precisely and efficiently than the standard on the market,” says Dr. Jörn Rickert, the start-up’s managing director. The electrodes are already being used before brain surgery. Users can narrow it down to the millimeter to determine where something is wrong and at which point an intervention must take place.

Currently, CorTec is currently being financed not only through initial revenues but also through family offices. “These are asset managers of wealthy families,” explains Rickert. The processes are fast and uncomplicated. Because family offices can pass on their holdings, they usually think long term. “They want us to be successful.” In many ways they resemble business angels. However, family offices often do not bring with them a network of specialist contacts, for which CorTec has compensated through its advisory board. According to Rickert, family offices are suitable for start-ups who do not pursue high-risk projects and at best already have sales. “The risk profile must be right - and the chemistry,” he says. Relationship management is important and time-consuming because the family office members are rarely experts in the field.

The contacts at CorTec came about through personal connections. “We have been very lucky,” says Rickert. Large strategic investors, he says, have cost too much independence. By contrast, high-tech, which does not yet have proximity to the patient, hardly generates large sums in crowdfunding. The last round of financing has earned CorTec almost six million euros. The start-up wants to further improve its implant technology “Brain Interchange.” “Our system is almost ready for clinical use,” says Jörn Rickert. He hopes that new therapies for neurological diseases will emerge: “Using the implants, for example, severely paralyzed patients should be able to communicate again.”

The electrodes are already being used before brain surgery. Users can narrow it down to the millimeter to determine where something is wrong and at which point an intervention must take place. Photo: CorTec GmbH

Jürgen Schickinger